A rewarding career as a real estate broker can be yours. If you have the right mindset, and desire financial independence, brokering may be the ideal career choice. It is important to remember that this career path can be difficult and takes a lot of work.

Real estate is a competitive industry, so many people fail to reach the top. You need to have years' of experience and meet certain criteria.

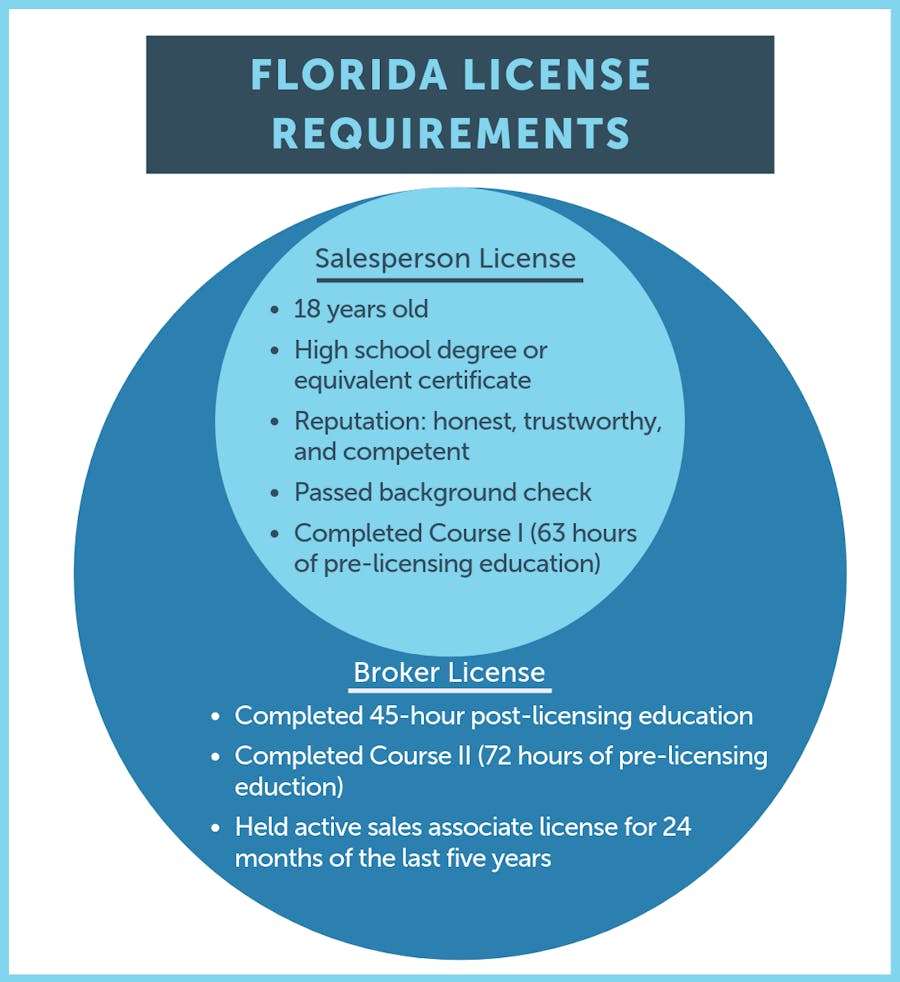

To become a licensed real estate broker you will need to have the proper license in your state. Finding a brokerage to sponsor you and give you training is the first step. Next, you must complete the required course to pass the exam.

There are many types of brokers you can choose from. These brokers are available to you as individual, corporate, partnership, or limited-liability company brokers.

You can also get a real estate broker license by incorporating a new business. Although it is a great method to build your brand and establish a strong foundation for your company, it will require planning.

To protect your business, you will also need insurance. Most insurances include auto, property (life and death), liability and property (property).

Before you decide to become a broker, think about how much money is needed for startup costs. It is also necessary to pay the licensing fees and cover any other costs involved in getting your realty broker license.

The cost of obtaining your license can be high, so it is important to plan well and save enough to pay for the required courses. This is especially true if the goal of your brokerage is to be self-employed.

Another option is to work as an affiliate broker for an established brokerage. You will collect desk fees along with a percentage of your agents’ commissions. You'll have additional responsibilities, including managing your team and overseeing their transactions.

Consider your options if you are interested in this career. You will have more responsibilities than agents and need to be knowledgeable about all aspects of real-estate. This means you will need to have an excellent understanding of the industry, how it works and communication skills.

Your staff must also adhere to ethical standards and law. This is a big responsibility. Make sure you spend the time to ensure that your employees are well-trained and adhere to all laws.

A great broker must have an in-depth knowledge of all areas of realty and be able guide clients through each step of the process. This knowledge will give them an advantage over other agents and could help them earn a higher percentage of commission.

It doesn't matter if you are a potential real estate agent, or if you are just beginning your career, it is never too early for you to start thinking about what you want out of your career and setting goals. By taking a strategic approach to your career goals, you can help ensure that your real estate career will be successful and fulfilling for years to come.

FAQ

What are the three most important things to consider when purchasing a house

Location, price and size are the three most important aspects to consider when purchasing any type of home. Location refers to where you want to live. Price refers the amount that you are willing and able to pay for the property. Size refers to the space that you need.

How much money do I need to purchase my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

How can you tell if your house is worth selling?

It could be that your home has been priced incorrectly if you ask for a low asking price. A home that is priced well below its market value may not attract enough buyers. You can use our free Home Value Report to learn more about the current market conditions.

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. This means that you won't have to worry about rising rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Purchase a Mobile Home

Mobile homes are homes built on wheels that can be towed behind vehicles. They were first used by soldiers after they lost their homes during World War II. People who want to live outside of the city are now using mobile homes. These houses are available in many sizes. Some houses are small while others can hold multiple families. Some are made for pets only!

There are two types main mobile homes. The first type of mobile home is manufactured in factories. Workers then assemble it piece by piece. This takes place before the customer is delivered. You could also make your own mobile home. Decide the size and features you require. You'll also need to make sure that you have enough materials to construct your house. The permits will be required to build your new house.

There are three things to keep in mind if you're looking to buy a mobile home. A larger model with more floor space is better for those who don't have garage access. A larger living space is a good option if you plan to move in to your home immediately. You should also inspect the trailer. You could have problems down the road if you damage any parts of the frame.

It is important to know your budget before buying a mobile house. It's important to compare prices among various manufacturers and models. It is important to inspect the condition of trailers. Although many dealerships offer financing options, interest rates will vary depending on the lender.

You can also rent a mobile home instead of purchasing one. Renting allows the freedom to test drive one model before you commit. Renting isn’t cheap. Renters typically pay $300 per month.