If you're looking for a multi family mortgage loan, there are several factors that you should consider. These factors include your down payment, the interest rate, and other financing options. This article will cover the down payments and rates applicable to these types loan. After you have the information you need, you can make an informed decision about which mortgage loan is best for you.

Multi-family mortgage rates

There are many factors that affect the interest rate for a multi-family mortgage loan. These loans have higher reserve requirements than conventional loans. This is because a multifamily loan carries a higher level of risk. This is why buyers should seek out a multifamily lender.

The traditional FHA loan program allows multifamily property owners to purchase up to four units. Its low down payment and lower interest rate are some of its benefits. There are also lower requirements and a lower DTI.

Down payment requirements

The requirements for multi-family mortgage loans vary depending upon the type of property. A multifamily property of three units may require a 20% downpayment while a multifamily property of two units may only require a 5% deposit. In addition, different banks have different guidelines regarding how much of a down payment is required on a multifamily property.

Although multi-family properties require a larger down payment, they can still be approved with a smaller down payment. Some programs may require as low as five percent down; some lenders may even allow zero down. You can also use the down payment of a relative or parent to finance a portion the mortgage.

Requirements for interest rates

A multi-family mortgage loan is available to those who meet certain requirements. Pre-qualification requires you to review your income and credit scores. Lenders require that you have a credit score of at least 680 to be approved for a loan.

Other financing options

Alternative financing can present some difficulties. These include limited documentation, a lack of data on the effectiveness of alternative financing, and wide variations among states in the types of alternative financing available. Policymakers may not be able to assess the benefits and harms of alternative financing if there isn't enough research.

Alternative financing options for multifamily mortgage loan requirements include private equity, debt funds, and online marketplaces. Private equity funds are used often to finance commercial real property deals. These funds pool capital from many investors and offer debt or equity financing to borrowers. This type financing is not appropriate for all circumstances and requires careful research.

FAQ

Can I get a second mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

How much does it cost to replace windows?

Replacing windows costs between $1,500-$3,000 per window. The cost of replacing all your windows will vary depending upon the size, style and manufacturer of windows.

Can I buy a house in my own money?

Yes! There are programs available that allow people who don't have large amounts of cash to purchase a home. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. Visit our website for more information.

What should I look out for in a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They look through different lenders to find the best deal. This service may be charged by some brokers. Others offer free services.

Should I rent or buy a condominium?

Renting may be a better option if you only plan to stay in your condo a few months. Renting saves you money on maintenance fees and other monthly costs. On the other hand, buying a condo gives you ownership rights to the unit. You have the freedom to use the space however you like.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

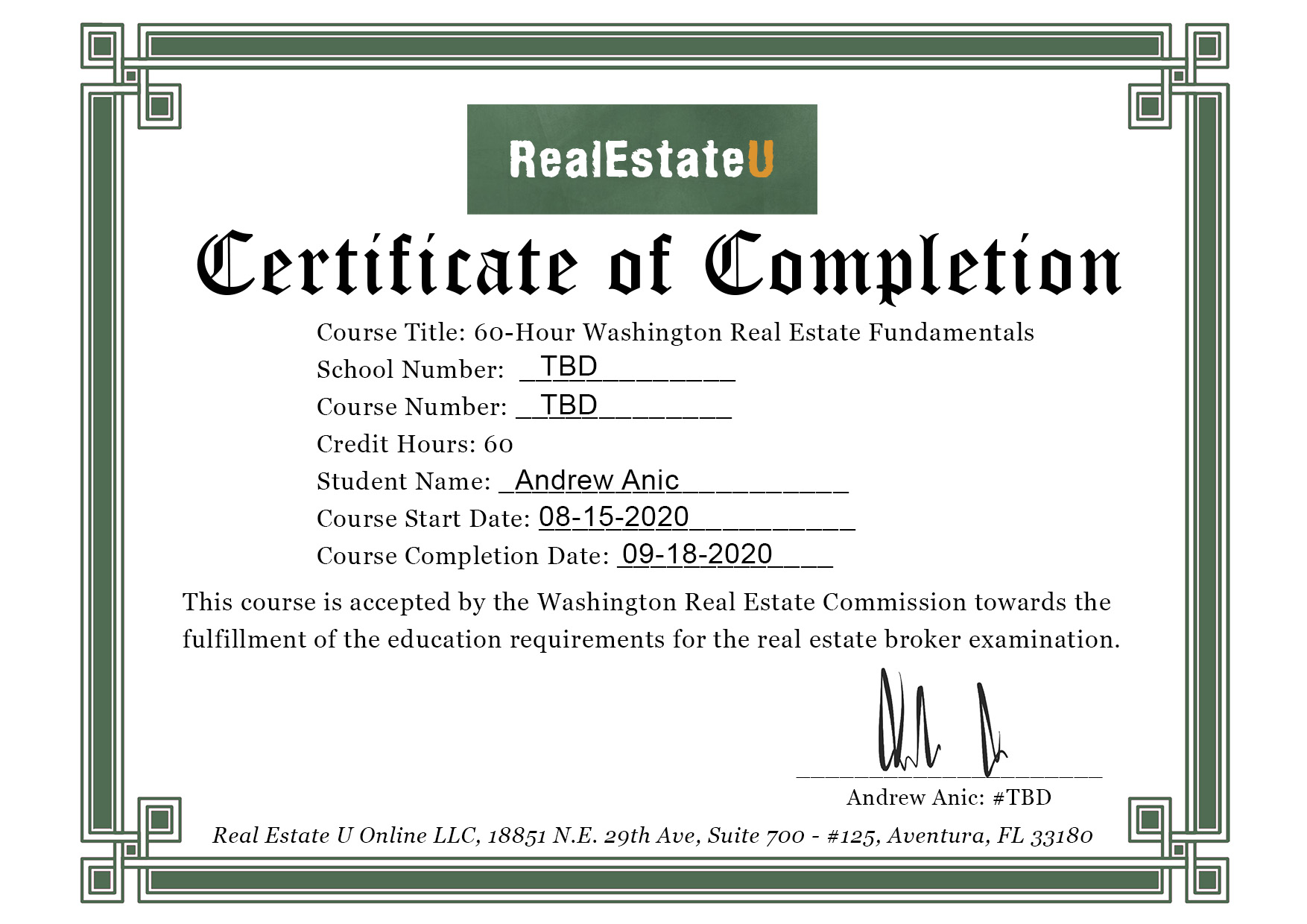

How to become a broker of real estate

Attending an introductory course is the first step to becoming a real-estate agent.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires studying for at minimum 2 hours per night over a 3 month period.

This is the last step before you can take your final exam. You must score at least 80% in order to qualify as a real estate agent.

Once you have passed these tests, you are qualified to become a real estate agent.