There are many benefits to renting out a property. This article will explore the rewards and challenges involved in doing so. It also covers financing options. There are many options for financing rental property. A local real estate agent can help you get information about the market as well as the property.

Investing in a rental property outside of your state

Renting out properties in other states can be a good investment. Many people in expensive areas will find that there are cheaper properties in other areas. This can lead to greater profits for the investor. Investing in rental properties outside your state can also help you diversify your portfolio.

Another reason to invest in rental properties outside your home state is because of the geographical diversity. This is a major advantage since you can diversify your portfolio by investing in rental properties in different areas. You can also protect it against total destruction in one area. Every state, each county, and every town is unique. A market decline in one region may not have the exact same impact in another.

Challenges

If you are thinking of purchasing rental property out of state, you should know that the process can be challenging. Even though out-of-state markets can offer better profits, you will need to spend more time understanding the area. If you want to be successful, it is important that you research the area online.

A smart move to diversify your real-estate portfolio is buying property outside of the state. However, it can be tedious and costly.

Rewards

You can reap many benefits by investing in rentals outside your home. You can diversify your rental portfolio by investing in out-of-state properties. This also reduces the possibility of total destruction. Secondly, every state, town, or county has a different economic system. The result is that a market decline in one area might not affect markets in the surrounding areas.

Finally, renting out of state is a great way to diversify your investments portfolio and earn passive income. It is important to understand the benefits and risks of renting your property. The laws that govern landlord-tenant relations vary from one state or another, even within one state. These laws can influence how you screen tenants and increase rents, or decline lease agreements.

There are several financing options

To invest in rental property in another state, you might need to jump through additional hoops to obtain financing. The best way to avoid these pitfalls is to research your financing options and get pre-approved before looking at properties. This will speed up the process when you find the right property and minimize surprises.

Another option is to approach banks or other lending institutions. If you have a track record of being a landlord and can prove that you are a risk-free borrower, a bank or lending institution may be more willing to lend you money. A down payment of at most twenty-five percent will be required. This will help you pay lower interest rates and lower debt-to-income ratio.

FAQ

What can I do to fix my roof?

Roofs can leak due to age, wear, improper maintenance, or weather issues. Roofing contractors can help with minor repairs and replacements. Contact us to find out more.

Is it better to buy or rent?

Renting is generally less expensive than buying a home. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. There are many benefits to buying a home. For instance, you will have more control over your living situation.

How much money will I get for my home?

It depends on many factors such as the condition of the home and how long it has been on the marketplace. Zillow.com says that the average selling cost for a US house is $203,000 This

What is a Reverse Mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. You can draw money from your home equity, while you live in the property. There are two types: conventional and government-insured (FHA). If you take out a conventional reverse mortgage, the principal amount borrowed must be repaid along with an origination cost. FHA insurance covers repayments.

How do I eliminate termites and other pests?

Your home will eventually be destroyed by termites or other pests. They can cause damage to wooden structures such as furniture and decks. This can be prevented by having a professional pest controller inspect your home.

How can I determine if my home is worth it?

If you have an asking price that's too low, it could be because your home isn't priced correctly. A home that is priced well below its market value may not attract enough buyers. To learn more about current market conditions, you can download our free Home Value Report.

What is the average time it takes to sell my house?

It depends on many factors including the condition and number of homes similar to yours that are currently for sale, the overall demand in your local area for homes, the housing market conditions, the local housing market, and others. It may take 7 days to 90 or more depending on these factors.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

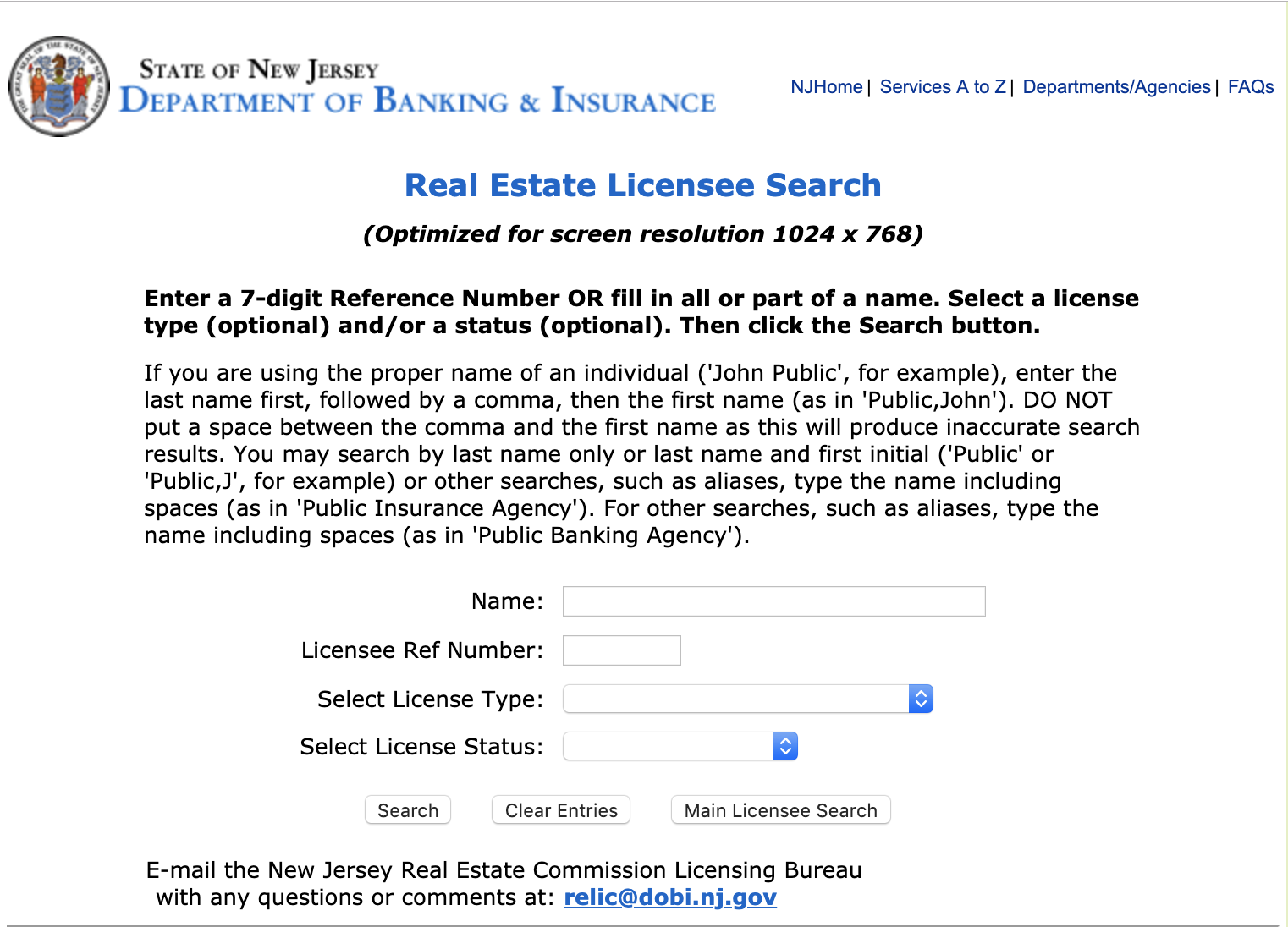

How to find real estate agents

The real estate market is dominated by agents. They sell homes and properties, provide property management services, and offer legal advice. A good real estate agent should have extensive knowledge in their field and excellent communication skills. For recommendations, check out online reviews and talk to friends and family about finding a qualified professional. Consider hiring a local agent who is experienced in your area.

Realtors work with sellers and buyers of residential property. It is the job of a realtor to help clients sell or buy their home. In addition to helping clients find the perfect house, realtors also assist with negotiating contracts, managing inspections, and coordinating closing costs. Most realtors charge a commission fee based on the sale price of the property. Unless the transaction is completed, however some realtors may not charge any fees.

There are many types of realtors offered by the National Association of REALTORS (r) (NAR). NAR requires licensed realtors to pass a test. Certified realtors are required to complete a course and pass an exam. Accredited realtors are professionals who meet certain standards set by NAR.