Real estate commissions are a major part of the process when buying or selling a home. It can be expensive and they can also make it difficult to understand the terms of your contract before you sign. This article will explain how they work and what it means for the buyer and seller of a home.

How much do real estate agents make in Florida?

An average Florida real estate agent makes $8,100 per sale. This is less than 6% of the total cost. The rate is slightly more than half that of the national median, 5.06 per cent. However, this number can vary greatly depending on a variety of factors.

What is the Work of Real Estate Commissions?

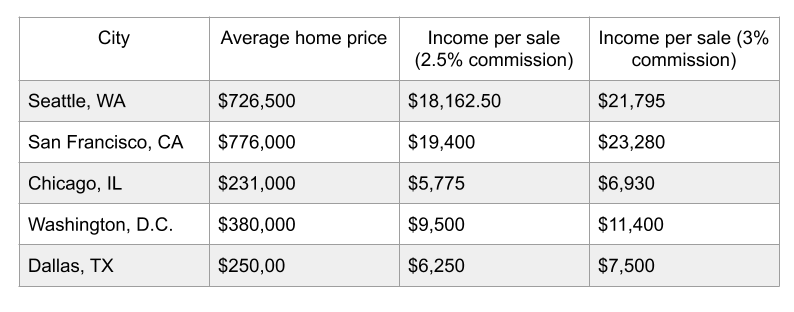

A real estate commission is a percentage from the sale price that is divided between the agent and listing broker. While this percentage can vary depending on the agent, it is usually 6% of sales price. The 6% is then split between seller's and buyer agents. The buyer's representative receives $9,000, while the seller's agents receive $4,500.

How Do You Calculate a Real Estate Commission in Florida?

A calculator is the best method to calculate a real-estate commission. You can find a variety of online real estate commission calculators that will help you determine the exact amount that you'll need to pay. This is especially helpful when you're trying to determine if you can afford the home or if you'll have to negotiate for payment options.

How Do I Negotiate a Lower Commission with a Realtor?

You should negotiate the commission you will pay whenever possible. Although it can be difficult, it is always worth asking. If you're dealing with an experienced agent who has a track record of working with sellers, you should be in a good position to get a lower rate.

How Much Commission Does a Realtor Make in Florida?

There are two types Florida real estate agents: brokers and sales associates. Both require a real estate license. A broker license is for those who work with buyers. A sales associate license can be used for people who deal with buyers. A sales associate license requires no experience and is easy to obtain; however, a broker license has more requirements and usually requires a couple of years of work under the supervision of a licensed real estate broker.

How do I make a good living as a Florida real estate agent?

Agents are professionals that help people sell their homes. They spend hours talking with prospective buyers and touring houses to analyze local markets. They assist people in making their most important financial decisions and often help them achieve their home-ownership dreams.

How Do I Become a Real Estate Agent in Florida?

FAQ

Can I get a second mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage can be used to consolidate debts or for home improvements.

What is the cost of replacing windows?

Windows replacement can be as expensive as $1,500-$3,000 each. The cost to replace all your windows depends on their size, style and brand.

Should I use a broker to help me with my mortgage?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers can negotiate deals for you with multiple lenders. Some brokers do take a commission from lenders. Before signing up for any broker, it is important to verify the fees.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. You may also lose a lot if your house is sold before the term ends.

How do I know if my house is worth selling?

You may have an asking price too low because your home was not priced correctly. If you have an asking price well below market value, then there may not be enough interest in your home. You can use our free Home Value Report to learn more about the current market conditions.

How long will it take to sell my house

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It takes anywhere from 7 days to 90 days or longer, depending on these factors.

Are flood insurance necessary?

Flood Insurance protects from flood-related damage. Flood insurance can protect your belongings as well as your mortgage payments. Learn more information about flood insurance.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to be a real-estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

Next you must pass a qualifying exam to test your knowledge. This involves studying for at least 2 hours per day over a period of 3 months.

This is the last step before you can take your final exam. In order to become a real estate agent, your score must be at least 80%.

Once you have passed these tests, you are qualified to become a real estate agent.