You need to go through many steps to become an agent in New York. You will need to complete the pre-licensing courses, pass the exam, and apply for your license. The entire process can take up to a few months, but with a bit of dedication, you can be a licensed agent in no time.

How to obtain your New York Real Estate License

The first step is to find a real estate broker who will sponsor your application and help you get started. It is important to choose a local broker who has a solid reputation and is willing invest in your education. Find out about their commission structure for agents, and the training they provide.

Next, register for the required 75-hour real-estate sales agent course/RESB1CE9503. It is a full-time program and takes approximately eight weeks to complete. You should choose a provider who offers both in-person and online classes.

Once you have successfully completed your courses, and passed your exam you will need to submit the application to New York Department of State. You can either mail your application or complete it online. An initial fee of $65 must be paid.

How to renew your New York Real Estate License

To continue your work as a New York real estate broker, or salesperson, you must renew your license every two years. You can do this through your eAccessNY Account. You will receive a renewal notice with instructions on how to complete your renewal application and submit the renewal fee.

After you submit your application, New York Department of State review it and sends you a confirmation of approval. You will be issued a letter along with a wallet card confirming your status to the state of New York as a licensed real estate agent.

What is the average annual income for a New York-based real estate agent?

As of this writing the average New York City realty agent is making $111,734 per annum. This is higher than average for the country, due to New York City’s highly competitive market.

How to Become New York's Real Estate Agent

The process of becoming a licensed real estate agent is fairly simple and straight-forward. The New York state exam must be passed and you will need to be sponsored by a licensed broker. Once you have your real estate license, you can start selling homes and apartments and earning a living!

How to Become A Real-Estate Agency in NYC

Accredited real estate schools are the best way to be a New York real-estate agent. These schools offer extensive courses that will prepare you to take New York's real estate exam.

Many real estate schools will provide all the information you need in order to become licensed agents. However, you may need additional study materials to help you pass the NY real estate exam. Some of the best resources for studying for the exam are Kaplan, which offers a variety of study materials to ensure you pass. RealEstateU offers courses that are designed by local experts, and can help you pass NY's real estate exam. To track your progress, and make sure that you're ready to take the NY real estate licensing exam, you can use the next generation student dashboard.

FAQ

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. Additionally, if you decide not to sell your home by the end of the term you could lose a substantial amount due to the difference between your sale price and the outstanding balance.

How long does it take for a mortgage to be approved?

It depends on several factors such as credit score, income level, type of loan, etc. It takes approximately 30 days to get a mortgage approved.

What is a reverse mortgage?

A reverse mortgage lets you borrow money directly from your home. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types: conventional and government-insured (FHA). Conventional reverse mortgages require you to repay the loan amount plus an origination charge. If you choose FHA insurance, the repayment is covered by the federal government.

What are the top three factors in buying a home?

Location, price and size are the three most important aspects to consider when purchasing any type of home. Location is the location you choose to live. Price refers to what you're willing to pay for the property. Size is the amount of space you require.

Do I require flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance can protect your belongings as well as your mortgage payments. Learn more about flood insurance here.

What amount should I save to buy a house?

It all depends on how many years you plan to remain there. If you want to stay for at least five years, you must start saving now. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

What should I look for when choosing a mortgage broker

A mortgage broker helps people who don't qualify for traditional mortgages. They shop around for the best deal and compare rates from various lenders. There are some brokers that charge a fee to provide this service. Others offer no cost services.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to Find Real Estate Agents

Real estate agents play a vital role in the real estate market. They can sell properties and homes as well as provide property management and legal advice. Experience in the field, knowledge about your area and great communication skills are all necessary for a top-rated real estate agent. You can look online for reviews and ask your friends and family to recommend qualified professionals. It may also make sense to hire a local realtor that specializes in your particular needs.

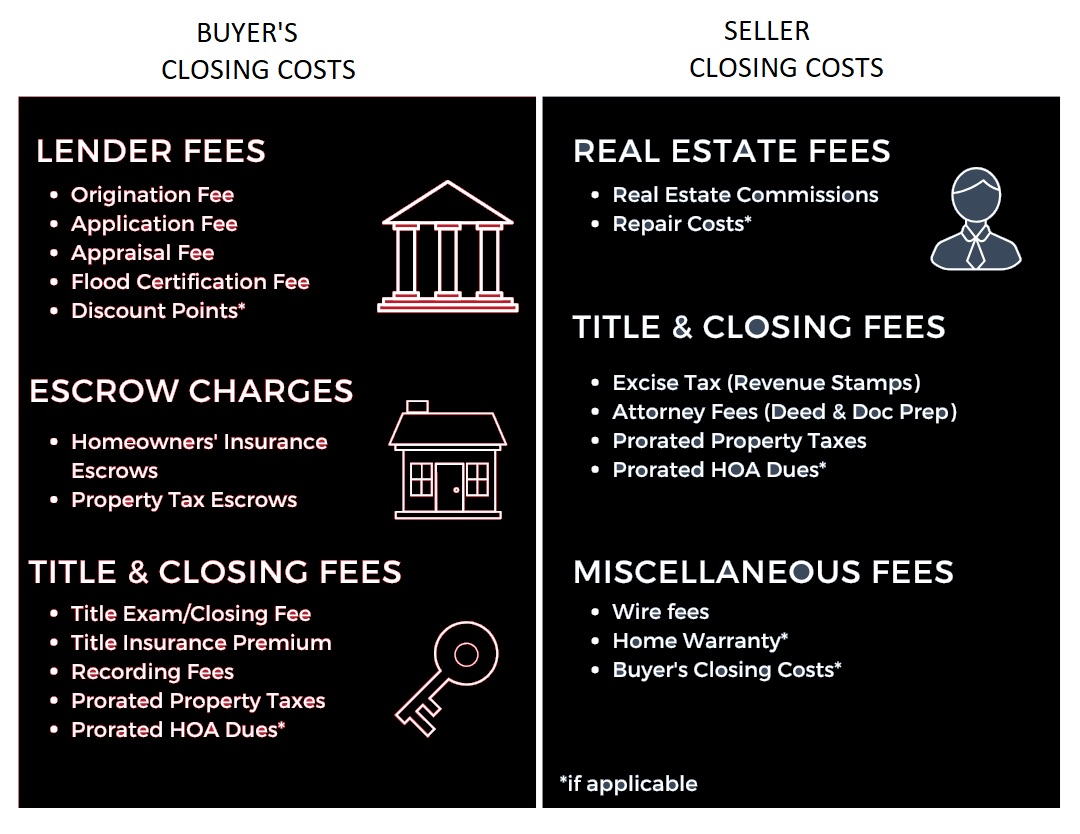

Realtors work with sellers and buyers of residential property. The job of a realtor is to assist clients in buying or selling their homes. A realtor helps clients find the right house. They also help with negotiations, inspections, and coordination of closing costs. Most realtors charge commission fees based on property sale price. Unless the transaction closes however, there are some realtors who don't charge a commission fee.

The National Association of REALTORS(r) (NAR) offers several different types of realtors. NAR requires licensed realtors to pass a test. To become certified, realtors must complete a course and pass an examination. NAR designates accredited realtors as professionals who meet specific standards.