If you have a 100k investment and are looking for an option that provides a passive income and predictable returns, consider real estate investment. Real estate investments offer the opportunity to earn huge equity, with little or no effort. You can purchase a million-dollar home with only 100k down, and then build enormous equity over time.

Real estate is the best way to invest.

Real estate investment is the best choice if you have more than 100 thousand dollars. Real estate not only provides a steady income each year, but can also be a valuable personal asset for the future. Real estate is a great way to diversify portfolios.

IRAs can be used as a passive investment.

An IRA investment can provide tax benefits. It is a good choice for 100k investments. You also have more control over your investments than a traditional 401(k), with the option to invest in stocks and ETFs as well as other asset classes. With the right investment strategy, you can grow your investment over the long term, while taking advantage of tax advantages.

Mutual funds

It is important to choose the best funds for your $100k investment. If you aren't careful, investing in stocks can be dangerous. Bonds, on the other hand, are less risky. However, you'll earn lower returns with them. It is important to take into account your age and overall health. And be sure to think about whether you can afford to let your money stay in one place for five or more years.

ETFs

If you want to invest $100 000, it is worth considering switching to mutual funds or exchange traded funds. These passive investments have low fees and can be set up to automatically invest recurring amounts over time. The benefits of ETFs over individual stocks make them one of the most popular investing strategies, as the barrier to entry is relatively low.

SIPPs for DIY

You should be aware of the following factors before you consider a DIY SIPP to make your first 100k. First, you'll need to choose an investment platform. Also, decide how much money you are willing to invest. Vanguard funds might be an option. You can also look into their SIPP. Other SIPP providers such as Hargreaves Lansdown, Fidelity, and Hargreaves Lansdown might be worth your consideration.

The tax benefits of investing in a retirement plan (401(k),)

There are many tax incentives to investing in your 401(k). The first benefit of a 401(k) account is its tax-deferred nature. That means that your money grows tax deferred until you take it out at retirement. This tax deferral benefit can be applied to traditional and Roth Roth 401 (k) accounts.

FAQ

Do I need a mortgage broker?

If you are looking for a competitive rate, consider using a mortgage broker. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. Before signing up for any broker, it is important to verify the fees.

How long will it take to sell my house

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It takes anywhere from 7 days to 90 days or longer, depending on these factors.

What should you consider when investing in real estate?

The first thing to do is ensure you have enough money to invest in real estate. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

Also, you need to be aware of how much you can invest in an investment property each month. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

You must also ensure that your investment property is secure. You would be better off if you moved to another area while looking at properties.

What is reverse mortgage?

A reverse mortgage lets you borrow money directly from your home. You can draw money from your home equity, while you live in the property. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers the repayment.

Is it better buy or rent?

Renting is typically cheaper than buying your home. However, you should understand that rent is more affordable than buying a house. Buying a home has its advantages too. You'll have greater control over your living environment.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

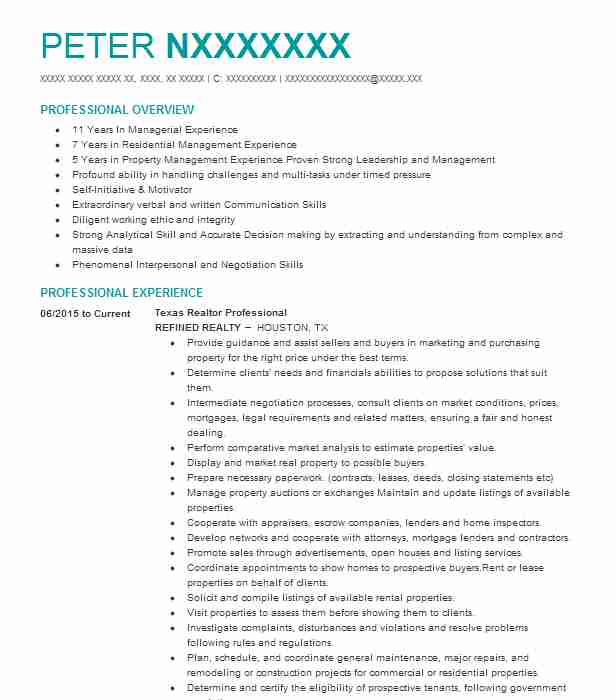

How to Find Real Estate Agents

The real estate agent plays a crucial role in the market. They help people find homes, manage their properties and provide legal advice. A good real estate agent should have extensive knowledge in their field and excellent communication skills. Online reviews are a great way to find qualified professionals. You can also ask family and friends for recommendations. A local realtor may be able to help you with your needs.

Realtors work with both buyers and sellers of residential real estate. It is the job of a realtor to help clients sell or buy their home. Realtors assist clients in finding the perfect house. A majority of realtors charge a commission fee depending on the property's sale price. However, some realtors don't charge a fee unless the transaction closes.

The National Association of Realtors(r), (NAR), has several types of licensed realtors. NAR membership is open to licensed realtors who pass a written test and pay fees. Certification is a requirement for all realtors. They must take a course, pass an exam and complete the required paperwork. NAR designates accredited realtors as professionals who meet specific standards.